Monterey County Property Appraiser

Assessor County of Monterey, CA

Locate and map all taxable property in Monterey County. Determine the ... 2026 County of Monterey, CA. Website Design by Granicus - Connecting ...

https://www.countyofmonterey.gov/government/departments-a-h/assessor/assessorCAA e-Forms Service Center - monterey

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/monterey

Decline in Market Value County of Monterey, CA

Government » Departments A - H » Assessor » Assessor-County Clerk-Recorder » Assessor » Real Property ... 2026 County of Monterey, CA. Website Design by ...

https://www.countyofmonterey.gov/government/departments-a-h/assessor/assessor/real-property/decline-in-market-valueMONTEREY COUNTY ASSESSOR OFFICE - Yelp

Monterey County Assessor Office - publicservicesgovt - Updated January 2026. Browse Nearby. BEST of Salinas, CA Coffee near Monterey County Assessor Office.

https://www.yelp.com/biz/monterey-county-assessor-office-salinasThe 1st installment of... - County of Monterey, California Facebook

The 1st installment of 2025-2026 property taxes is due and payable on November 1, 2025. To avoid penalties, payment must be made by 5:00 PM (or close of business) on December 10, 2025. La primera cuota del impuesto a la propiedad 2025-2026 se vence y se puede pagar a partir del 1 de noviembre de 2025.

https://www.facebook.com/MontereyCoInfo/posts/the-1st-installment-of-2025-2026-property-taxes-is-due-and-payable-on-november-1/1261559192682522/

CAA e-Forms Service Center - Monterey: BOE-266

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/monterey/form/BOE-266

Business Property County of Monterey, CA

The filing dates for both e-filers and paper filers are as follows: April 1, 2026: Business property statements are due. May 7, 2026: Final day to file business ...

https://www.countyofmonterey.gov/government/departments-a-h/assessor/assessor/business-propertyMonterey County Property Tax Collection Changes News montereycountynow.com

Property tax checks in Monterey County are no longer headed for Salinas. For the first time when last month’s Dec. 10 deadline rolled along, all property owners who paid by check using a provided envelope sent their payments to a contractor in Whittier.

https://www.montereycountynow.com/news/local_news/monterey-county-tax-collector-brings-changes-to-how-property-taxes-are-collected/article_de181ade-bb05-11ee-8ce2-3338331612ed.html

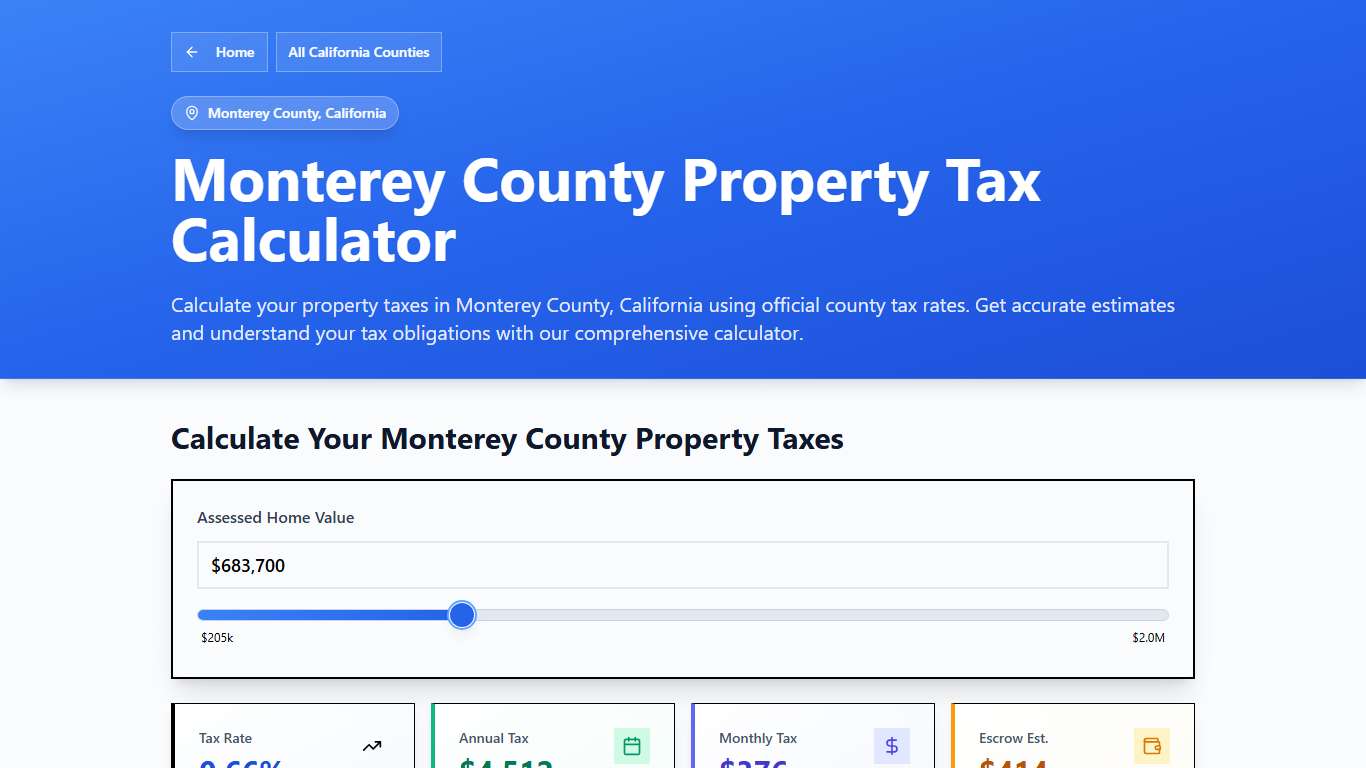

Monterey County, CA Property Tax Calculator 2025-2026

Calculate Your Monterey County Property Taxes Monterey County Tax Information How are Property Taxes Calculated in Monterey County? Property taxes in Monterey County, California are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.66% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/california/monterey-county

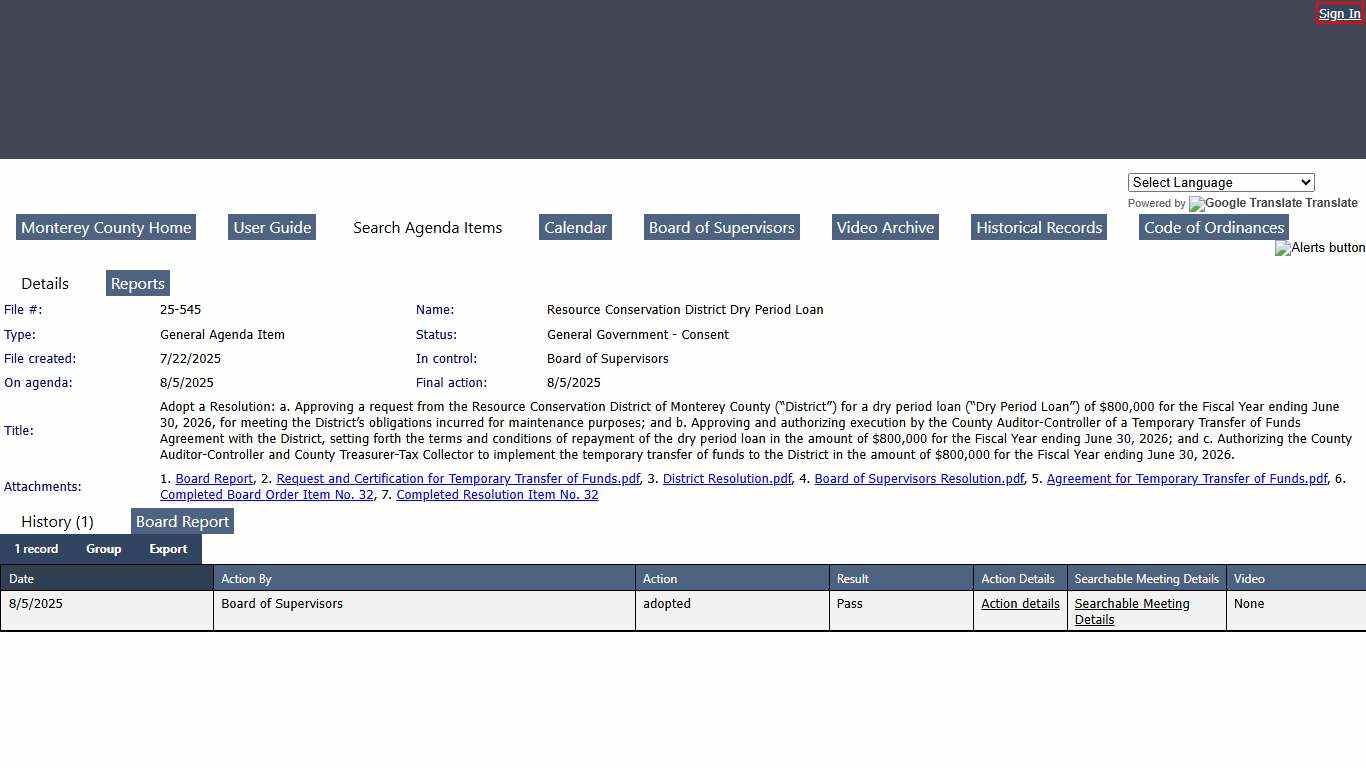

County of Monterey - File #: 25-545

Title Adopt a Resolution: a. Approving a request from the Resource Conservation District of Monterey County (“District”) for a dry period loan (“Dry Period Loan”) of $800,000 for the Fiscal Year ending June 30, 2026, for meeting the District’s obligations incurred for maintenance purposes; and b.

https://monterey.legistar.com/LegislationDetail.aspx?ID=7497036&GUID=3C8282D7-8CC5-4F41-869C-E99984B44C87&Options=&Search=&FullText=1

2026 Rental Affordability Report: Buying vs. Renting

Home ownership consumed less of residents’ typical wages than renting in 57.7 percent of counties; Median home prices rose faster than rent in 69 percent of counties IRVINE, Calif. –Jan 22, 2026 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its 2026 Rental Affordability Report, which shows that in more than half of counties analyzed, owning a home is more affordable than renting...

https://www.attomdata.com/news/market-trends/home-sales-prices/2026-rental-affordability-report/

2026 Monterey, California Sales Tax Calculator & Rate – Avalara

Monterey sales tax details The minimum combined 2026 sales tax rate for Monterey, California is 9.25%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The Monterey sales tax rate is 1.5%.

https://www.avalara.com/taxrates/en/state-rates/california/cities/monterey.html

More property tax relief available to Monterey County homeowners

MONTEREY COUNTY — Monterey County residents who need help after falling behind on house payments during the Covid-19 pandemic can still get assistance through the California Mortgage Relief Program, which is expanding eligibility requirements to help more homeowners catch up on past-due payments and get a fresh start. The program has extended assistance to cover [...]...

https://californialocal.com/localnews/monterey/ca/article/show/6669-more-property-tax-relief-available-to-monterey-county-homeowners/